The SCOTUS ruled to reject student loans forgiveness. This is one of many important cases that seem to be seemingly decided over party lines. Why is that?

Article 3 of 3 regarding the recent U.S. Supreme Court (SCOTUS) Rulings

The U.S. Supreme Court Conservative Majority decided on several cases that will reshape the way U.S. legislation could be affected for generations to come. This is the third of a three articles’ series covering the SCOTUS recent ruling, and what does it mean to America. This is an ongoing story about U.S. President Biden’s proposal to forgive student loans.

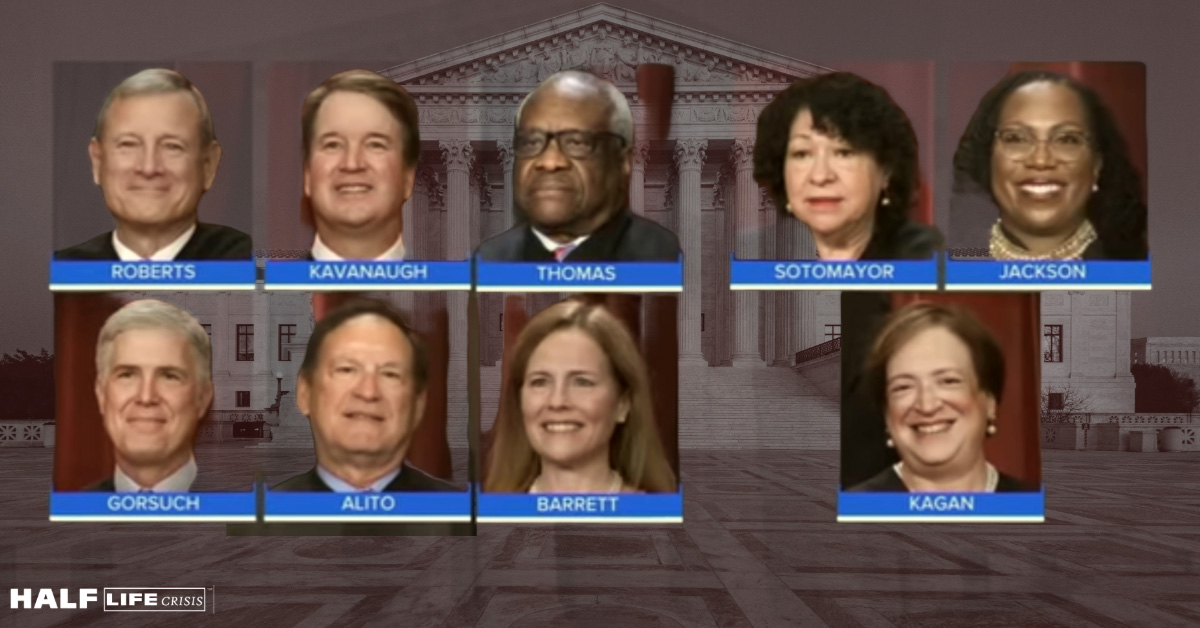

In the previous articles we spoke about the case regarding a fictitious same-sex web site – as in the fact that there were zero actual same-sex customers asking this lady for a web-site for their wedding. The second of the series was about Affirmative Action and how the ruling in essence destroys Affirmative Action, and how it very well affect future minorities applications for a competing chance in society. In this article I will talk about the Student Loan Forgiveness cases. As I said there is also quite a developing-follow up story on that ruling. In either case, for all of these cases the Supreme Court ruled 6-3. That means that the six conservative Supreme Court Justices decided against all dissenting parties for the three non-conservative Supreme Court Justices.

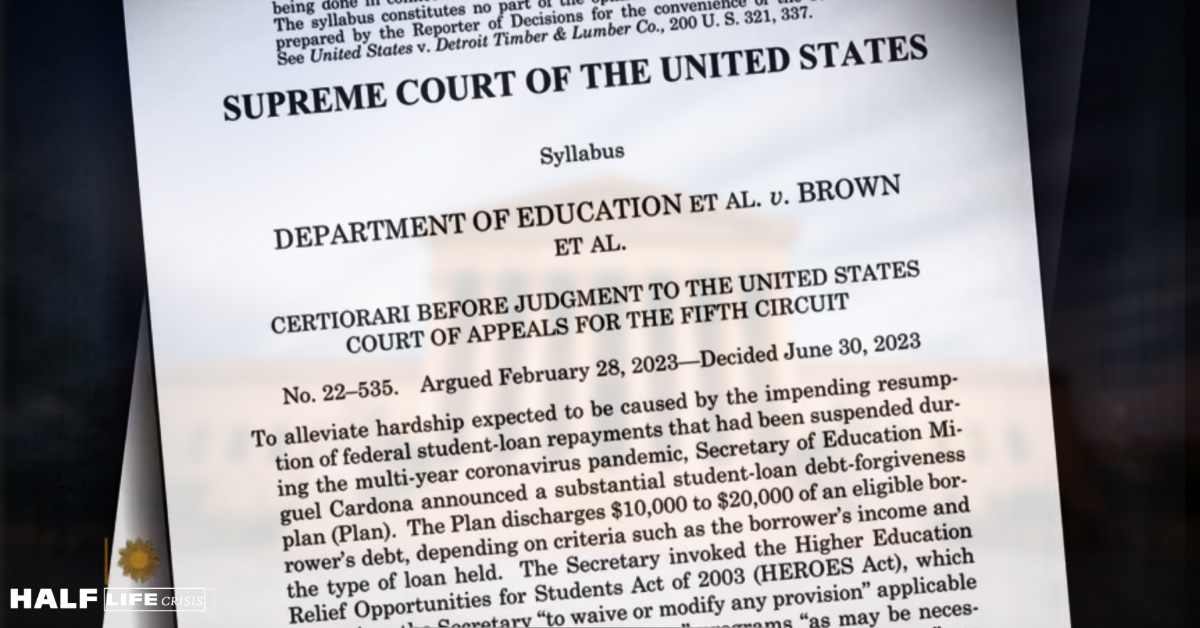

© 2023 Marcelo Baqueroalvarez / HLC | SCOTUS case decided 30 JUN 2023

© 2023 Marcelo Baqueroalvarez / HLC | SCOTUS case decided 30 JUN 2023

So, what is the big deal?

This case was for the Department of Education Et All. versus Brown Et All. The case entered argument into the Supreme court on February 28, 2023 and decided on June 30, 2023. By the ruling on this case, then any alleviating of debt for exuberant federal student-loans was denied. This request to alleviate student debt was set forth by President Biden during his last State of the Union Speech. And to paraphrase, he argued that helping people finish paying the high interest student loans earlier will benefit the country.

And although this is actually true – if you understand the full context behind it, it is not without a lot of variables. But starting from the basics, it is extremely expensive to get a higher education in the United States of America. But it shouldn’t. This was not always the case. In fact, back a few decades ago, or even when the previous generation was of college age (especially baby boomers), a person could have paid for their college with the earnings of a summer job. That is a far cry from what the cost of college represents today.

In fact, things have gotten not only exponentially more expensive when it comes to higher education – but also it became the norm for “minimum requirements” for many job positions. Never mind that many of those job positions were well below a level of comfortable living, or even a sustainable living wage. And we’ll talk a bit more about that in a moment. Before that just consider this. What if a debt kept growing and growing, and when you think it is almost eliminated, somebody with a bit more money buys YOUR debt and resells it for profit to SOMEBODY ELSE – while YOU as the borrower are still stuck with repaying it? If you think that is fucked up and should be illegal; then welcome to the reason why getting respite from student debt is such a hot button issue being argued at this point.

And yes, that re-selling and interest hikes does happen. For instance, once debt is out there for grabs and re-selling. That means it can be bought and sold without notice to the original borrower, and this interest can hike exponentially. For example, essentially making a 20K loan amount to be repaid balloon to 80K. This is despite the fact that consistent payments have been made the entire time by the borrower. That is the part a lot of people against respite for student debt don’t talk about. Most of the people looking for respite have very much paid well above their principal amount. We’ll chat about this and a bunch of other myths about these “slick-students” and misinformation about student debt.

Victim Blaming

I’ve spoken about this in my writing at some point. There are a few memes that show a stern looking cartoon dude with an easel and a pointer towards something that says, “you borrowed money” and in the next slide points the same thing to “you pay it.” Well, no duh! And of course, this meme is likely from a propagandist that is hoping most naïve people miss the point. The point is that the number (amount) agreed in the loan has grown exponentially, and it won’t stop growing – no matter how much it gets repaid in installments. And this type of debt is so harsh that not even bankruptcy or short of being dead will free you from it.

But wait! It gets more insidious. And to illustrate how bad it is, let me explain to you with an illustrative analogy.

Let’s say that you need to rent an apartment. Because of course you need shelter, and it is a basic necessity for urban survival. You know, a place where to rest, to call “home,” and safe enough to hold your worldly possessions. At the time you’re signing that lease there is a lot you don’t quite know about the world, after all this is your first time out and about living as an adult. That’s ok, nobody is born knowing everything. Mistakes are part of the human learning process. And some predatory entities are hoping for you to be inexperienced enough.

So let’s say that in this case you agreed to pay for the lease an “x” amount of money per month, plus utilities, and “some maintenance incidentals.” Let’s make it a round number and say that it was only $1000.00 a month for a studio apartment, and you factor another $200.00 a month for utilities if you are frugal enough to have a “decent” lifestyle within your means. But that is easier said than done. Your job only brings $2000.00 a month after taxes. So right of the bat you’re well above 50% of our income just to cover your most basic needs, which is to have a roof over your head with basic utilities. In other words, a domicile.

You are making your regular rent payments, living a very frugal life. Taking the bus instead of buying a car, eating at home instead of dining out, and tapering any entertainment that would hike your expenses. After a couple of years of living in severe austerity you are able to save a couple thousand bucks for a security deposit and utilities downpayments, so you can finally move out and start a life elsewhere. You calculate that in a few months you’ll be able to depart this area and accept a higher paying job elsewhere. You’ve been working very hard to make this attainable, your current job has a very fluctuating schedule. Sometimes you work mornings, and in short notice you have to work nights or other times. All of which makes it harder for you to even attempt getting a second job.

However, suddenly the area where you are renting your studio apartment changes owners. And suddenly your $1,000.00 payment hiked to $1,500.00 and if you don’t pay this higher amount, you’ll get evicted and even lose your security deposit. What is the first thing that takes a hit? Your savings.

Now you have to tap into that rainy day fund that took you so long to save just so you can maintain this meager status. Which means that now you’re needing to spend $1,700.00 a month from your $2,000.00 paycheck to live in the same spot you were living before. Somehow you make it happen, but your level of personal austerity is tighter than ever.

And just as things could not get worse, then somebody else buys this living complex and your new landlord demands a hike on payment. And yes, stuff like this does happen. Especially when renewed urban areas are growing, and displacing “lower income people.”

Suddenly your $1,500.00 a month rent payment balloons another $200.00. So now, for you to stay in that studio apartment it will set you back $1,700.00 a month plus what you’ve been able to frugally set as expenses of $200.00 – so that leaves you $100 bucks for ALL other expenses. You have now to figure out what to do next. Surviving in a place you cannot even leave is costing you pretty much all the money you make in this particular town. You’re living for working, and not working for a living. You realize you cannot even move, because even trying to leave it will cost you more than you have even saved to pay a security deposit, the moving costs, and even transportation to another town. Unless you want to incur more debt, and perhaps lose all of the little leverage you have over your life.

Despite all that, you’re finally able to work with one of your relatives to help you move out and live in a spare bedroom in their house. And just as you thought this nightmare was over, the landlord sends you an astronomical bill about those “incidentals” you didn’t think about could come to haunt you when you signed the original lease.

You were always a good tenant keeping the place tidy. The landlords never actually had to come to “fix anything” because you took care of the property. However, the last landlord claims that they caught some wear and tear and other maintenance issues that they “caught” after you left. And you better pay this or go to court or face jail. The damage they assess is well over $3,000.00 – and it better be paid quickly. This is despite the fact that you were doing regular payments, and the landlord was supposed to be checking the habitability of this place regularly to ensure there was no maintenance damage to the dwellings. However, you cannot afford an attorney. So, you either pay the $3000.00 or try to fight in court and possibly lose the case, and be forced to pay $3000.00 plus attorney fees, plus court fees, plus any other expenses. What would you do in this situation? And yes, if you were in the same circumstances as this person.

I will let you read this over again and try framing it in the lens of student loan that keep hiking. I’ll do a more direct connection in this article, But I just want you to think about it for a second. Put yourself in the shoes of this young tenant, with the same level of knowledge he would have had at the time. It is easy to judge people from based on what “we know,” much like being a “Monday quarterback.” – For this exercise I need you to have outmost empathy. What is your assessment?

The Federal Student Loans Reality

This student loans debacle is a proverbial double edge sword. A few years ago, it was “common knowledge” that as soon as you finish High School, you were supposed to go to college, pick a degree and park yourself in whatever industry you chose to affiliate yourself with, and make a comfortable living as an adult.

The reality is that a lot of people who did graduate college do not work in the field they studied. And the reasons for this phenomenon are varied. For example, there is such a thing as an oversaturated market. When I was growing up in Ecuador before I arrived at USA, the degrees “everybody” was pursuing were as follows: Business Administration, Economy, Finance and for some reason Clinical Psychology.

I have a friend who preferred to study cinema and pretty much everybody “who knew better” at the time said to him that it was a wasted career. Fast forward and to my knowledge he are the only one who actually owns a thriving business in the line of work he followed as his passion and vocation.

Markets are relative. And saturation of any industry could happen based on the supply and demand for that area. For example, too many restaurants from a particular gastronomy-type in the same block could create an oversaturation for that market. But what if the demand is very high and consistent, and everybody who fancies that type of food returns over and over again to the area, even if that means sampling each and every of venues menu available to the clientele. But conversely, if there is a different type of clientele who do not care much for that type of food, or at least does not want to eat that similar style-food too often, then the entire group catering to that style of food will have a much harder time to be sustainable. More than likely one of those will thrive and the rest who were not as good or competitive (and might not be flavor alone situation, but many other factors), could ultimately go out of business.

How this market will sustain or would change is anybody’s guess. Neighborhoods change. It could be as simple as somebody builds a community nearby to bring more business to this area, or it could be detrimental such as somebody putting high tolls in a major road forcing people to take a different route. We need to understand the obvious, there are always tons of factors outside our control, no matter how adept you are at planning, things will change at some point. Sometimes in your favor, sometimes against you.

I also read about people blaming “liberal arts degrees” as the reason why alumni are unable to finish paying their student loans. And guess what? A lot of alumni with business, finance, administration, medicine, law, engineering, chemistry, or any other industry are also unable to pay their student loans. Why? Because these loans keep hiking the amount owed exponentially, and this makes very hard for anybody to repay it.

In other words, if the goal post keeps moving, then we are never able to catch up to the finish line. The problem is that SOMEBODY OTHER than the parties originally involved keeps moving the goal post. That is why we keep seeing this phenomenon growing and growing. So that begs the question, how did it get to this?

© 2023 Marcelo Baqueroalvarez / HLC | SCOTUS cases decided were decided in the same split ruling 2023

© 2023 Marcelo Baqueroalvarez / HLC | SCOTUS cases decided were decided in the same split ruling 2023

Understanding Special Interest Groups when it comes to debt

Debt is BIG business. Yes, buying and selling somebody else’s debt is a huge industry. And that is not only true for USA, but many places around the world had jumped into it. And this can be very surprising to some people who do not understand that this is even a possibility. I mean, who would like to buy somebody’s debt right? Well, as I say this happens around the world, and it does not only apply to student loans.

So why do they do it? Well, because there is a lot of profitability when somebody already had been stuck with a debt. Some of these companies are able to buy somebody’s debt pennies on the dollar and then add their own rules against the original borrower. It should be illegal, but it is not. And when it comes to high finances there are all kinds of legal loopholes and ways to navigate these opportunities. I won’t delve too much into that for this article for two reasons. First because I can speak for hours about it, and this article is already pretty long. And second because it might piss you the fuck off because of legalized way people can get other vulnerable souls in serious quagmires.

So, let’s keep this in mind when we talk about debt. Somebody has a vested interest in keeping other people in debt. Debt is a weird situation, because you need debt in order to be “trusted” enough to build a living. But if you mismanaged it, it could destroy your life. And this mismanagement is the key word, because YOU do not really have that much control over the management of your debt.

So, let’s do an oversimplified understanding of credit. For the united Sates of America, the way you are considered your creditworthiness is based on whatever the bureaus (who do not particularly care about you) have on file about you. These bureaus are Equifax, TransUnion, and Experian. And no, they do not really talk to each other about YOUR debt. So, if you have a good rating in one of them, that does not automatically mean you’ll have a good rating with the other two. And if you have no credit history, then you don’t get enough evidence to show your “credit worthiness.” And life is very tough in America if you have bad credit or no credit.

Under the “Fair Isaac” construct, your FICO (Fair Isaac Corporation) score goes from 300 to 850 points. It used to go to the mid 700’s for the highest possible score, but that scoring system is long gone. Anything over high 700’s means you have all things considered very good credit, anything below mid 700’s it starts to be found “problematic” for lenders. Obviously the lower the score the more “problematic” the person’s creditworthiness seems to those lenders – or to even think about extending you credit. In other words, this number tells the lender how “risky” you are if “credit” (credit card, loan, etc.) has been given to you. And guess what, when you have a low FICO score, then your interest to repay any loan (and a credit card is essentially a loan on demand) would be usually pretty high. Which should be super counterintuitive that the less money you have, the more you have to pay for a debt, no matter how big or small.

And of course, this FICO score is based on your “available credit.” For example, let’s say that you are starting out your credit history only manage to get a credit card with a $1,000.00 credit limit, and an insanely high APR, let’s say 20% interest. That $1,000.00 is your “available credit” or the max amount you are able to “borrow” when you make a purchase with your card. And yes, have to pay back with actual money whatever you spend with your credit card. But there is a catch, if you use more than 25% of your available credit then your FICO score takes a dive. And if you don’t use it at all, then it also does not help you your credit. So, you need to pay “something” with this card in at least some intervals to show you’re “managing your debt.”

So that means that if you use this card with 1,000.00 bucks of available credit, when you make a $250.00 purchase, this already places you as a “risk” to the lenders. Your FICO score likely goes down (and interest tend to go higher the lower your score), and if you don’t pay it in a “smart manner,” these 250 bucks will become a bigger and bigger number to repay -depending on the interest in your card. Which as I said, for people with low credit it can be astronomical.

So, let’s say for the sake of argument (and to simplify the math) that your card has a 10% interest. That means that you are in essence paying 10 additional cents for every dollar you have used in your balance. So, let’s say that you were able to only pay $50.00 from the 250 bucks purchase in your first payment, and your balance now is $200.00 – is it only 200 bucks? Careful, because there is a time limit before it balloons.

For all intents and purposes, it is not, your balance is 220 bucks because 10 cents per every dollar is being charged to you – the 10% interest on the whatever reminder balance you have. 10% of a $100.00 is $10.00. Yes, for this example 10 bucks per every 100 dollars. Might not sound like much, but remember, you just paid 50 bucks, and you are still stuck with 20 additional bucks before you can pay your $200.00 remaining balance. And if you are not “smart” about managing your credit limit, these fees and interest will creep higher and higher. By the way, that is why a lot of credit card companies will have a pretty “small” minimum payment required. And if you guessed that this interest rate also makes your balance higher and keeps you as a higher risk to lenders AND lowers your credit score… congratulations, you’re paying attention.

But now that you understand the basics, the actual business model is more complex than that. Afterall, the lenders need to make money, right? Sure, that’s not the problem, it is how this can be manipulated in a way that can go in overdrive and destroy a person’s financial stability. This possibility of abuse is an unfortunate by product in the financial industries because the way you are supposed to forge a living in the US is by building creditworthiness and debt management. Chances are that most people do not have unlimited amounts of money just piling around in their home… as in piles of cash. No matter who you are, it is likely is that at some point you will need to make a significant purchase. And this purchase will require credit.

Examples? Sure, you might want a house, or a car, or furniture, or appliances, or services for your house that are expensive enough to deem financing. None of the things that I mentioned are likely purchased outright with hard cash. Why? Because first of they are probably super expensive, and most people are not likely to have the full amount in cash even if they have saved money for a long time. This money is either tied up on a financial instrument or at the very least in a bank account. And yes, banks are very leery about letting you make large withdrawals. So, if you go to your local bank and try to withdraw, say a couple hundred thousand dollars, that might not happen as easily as if you were withdrawing say 300 bucks.

In fact, many banks won’t even open a bank account with you if you don’t have credit history. So, think about this for a moment in the context you already have by virtue of this article. If you have already been paying off your ass with high interest rates and everything you borrow has a high-as-shit interest because you are already paying a lot of money for any other necessity, then of course it is going to be harder to pay any of that debt off. It is not so much as how much income you earn, but more about how much you’re paying in interest for a debt that keeps growing larger and larger. This can creep very quickly, but so subtly that for some people it will look like a surprise when the number to pay back has raised like a rocket.

Predatory lending is a multi-billion-dollar industry, because it preys on the most vulnerable segments of the population. These are ones desperate for ending an out-of-control debt. But as I mentioned, generally speaking the individual person does not have that much control over their debt, even if they do everything right. Whomever is holding your debt might very well make it harder to you at a moment’s notice. That is sometimes even printed the very, very small fine print.

For example, let’s say that you own a house, and your mortgage and escrow is financed by a particular financial institution. But consider, what if the institution who originally lend you the money goes out of business and a suddenly a different financial institution buys your debt? If you guessed that now you’re likely stuck to the whims of this new institution, and that you indeed need to pay that debt to them, then you would be correct. It is one of those things that should not be legal that is very much legal, and there is a very strong lobby groups to keep it as such.

Let’s discuss the factors for Student Debt

So now that you understand all that these deceptive tactics do exist, let’s compound the problem when it comes with student debt. A lot of people who got student debt were already overcharged for a service that should have cost possibly only a fraction of what this artificially inflated price is demanding of them. Pure and simple.

Going to college in the United States of America is insanely expensive, but it is extremely easy to get a student loan – yet extremely hard to repay them.

Think about it for a second in the most cynical manner you can. Does that make sense to you as a person? Of course, it does if your end desire is to milk a student’s money for as long as you can – even years after they left your campus. And to add insult to injury have them pay a lot more over time that what they would pay if it was even possible to pay it outright.

As I said before, for example a $20,000.00 degree plan that ends up costing north of $80,000.00 when it is finally repaid. And of course, this number is conservative. The semester hours in the majority of higher-education institutions are exceedingly expensive, and that tuition does not include all the other expenses such as housing, textbooks, computer (machine, software and peripherals), office supplies, and a bunch of other shit that you need to do your schoolwork and homework.

Let me give you an example. In the United States Navy, we have something called “tuition assistance” and some of our Sailors can apply for that benefit in order to pay for the tuition of a college class or more (up to three at the time) while in uniform. But attending these courses is still super expensive. Why? Because this aid does not include the textbooks and a bunch of other materials a lot of those classes require from their students. And those required items can set you back a few hundred dollars. And if you think you can use an older textbook (even if your buddy took the SAME class the previous semester), then you are not paying much attention. These textbooks are always super expensive and tend to be one-class only, even if the next semester it is the exact same class.

I know that for a fact because I have taken a few college courses while in the Navy and got my degree before my time in uniform. And even with this tuition assistance it can be very expensive for Sailors, and these textbooks prices were no joke, and often you could not sell it. Or if you do, it will be for a faction of what you paid for. By the time the class was over a new text edition made your super expensive book obsolete. And if THIS text did not release a new edition, you could be sure that a different textbook for the class would suddenly be required. Also, if they don’t get a good grade the Sailor will have to repay the full cost of the class. And of course, the higher education level for each college class the more expensive it is.

But of course, pairing it with the Operational Tempo and the Sailor’s duties and responsibilities, pursuing college while in uniform can be quite challenging. Hence there is a limit of how many classes you can take per semester as military member.

For example, the number start at one class at the time and depending on if you have proven to your chain of command that you can manage you might be able to increase the number of college classes you can take up to three. There are also a lot of other rules needed even to get the opportunity to apply for Tuition Assistance. But getting money for college is such a big deal that it even works as a recruiting tool. Who would have known? But the point is that even with all that help, college is very, very, very expensive.

And only part of makes it so expensive are the aggregated costs. I’ve mentioned the textbooks as one of those aggregated costs. Let me give you an example. When I went to college, one of my classes was for computer science – back in the late nineties. The professor was a bit of an asshole. But you had to purchase this extremely expensive textbook which really looked like a bunch of printed picture pamphlets with a ring… kind of like a big notebook. This fucking textbook was over $300.00 bucks in 90’s money.

My bother took the SAME class before me, and now his expensive ass textbook was no longer valid for this class.

If you did not have it, this dumbass teacher would kick you out of class. And no, you were not allowed to share it with another student (even if not scheduled at the same class time). And he did kick a few students out of class because they did not have this expensive-ass book the first day of class. Do you know how many times we used this fucking book? Twice. And in one of those times, he made us RIP a page and fold it somehow for no particular viable reason except that to doodle some shit on it.

And yes, that was likely a way for him to know if somebody has borrowed this book from a different student. Of course, that bullshit tactic also made that expensive ass book non-resalable. So now we were stuck with this fucking $300.00 plus book worth nothing in resale value. And to add insult to injury the pages in this fucking book were already obsolete by the time it was printed. Did we need a book for the class? No, it could have been a damn power point presentation for all the material we had to use this book for. I’m still angry about it and this shit happened in 1998.

I don’t know if somebody punched this motherfucker’s lights out, but I think I heard a rumor that it was the case from one of my old classmates with whom I shared the class. He sure deserved it, but it was not me who punched him though. Fucking punk-ass.

Stupid stories like that were not unusual when it came to textbooks and college. I am sure it might be similar today in some instances. But there are a lot of other aggregated costs. For example, some trips, or meals, or dorms, or fees, or even social gatherings. It is not like you can just be a ghost in college. Because you also need to network and show face in the industry you are competing for. And of course, depending on your academic institution, they might not give a shit about your down time. For instance, homework, and projects and other shit that is linked to your grade will take a lot of time to complete. So, if a person needs to study or work or make a living while finishing all their college work, it will be challenging.

I’ll be honest, I’ve taken several college classes while in uniform, but the last one was several years ago. I have not had the time to take any more college classes. I simply cannot afford the time, so I talk myself out of it. Any down time I have I much rather spend it with my wife and daughter. My job as it is – being on a ship is already insanely time-robbing.

But nowadays, there is a much higher realization to this paradigm. A lot of people with college degrees are not doing very well financially, and other with an actual trade or marketable skill make a lot of money. For example, a plumber or an electrician can out-earn many college grads. There was no college degree needed for that trade, but as long as they get their credentials and certifications for licensing, they are good to go and can make tons of money.

I realized it as much long time ago, and that’s when I decided to really study for a career that aligns with the skills I love to perform as a person. In my case video (multimedia) production. Of course, that because I am still serving in Active Duty my available time to do anything other than this job in uniform is very limited. But if I am not “working” – this is what I like to do. And I like the old adage that if you love what you do, then you’re not working a day in your life. And I love multimedia production. That’s what I plan to do after I retire.

For example, this bit of down time that I have (for example as I am underway at this time and finished my world load for the day), I am spending it on one of the many creative medias. In this case writing. I am lucky enough to have regular high income to allow me to create more and more of a portfolio on what I like doing.

In this case part of my content creation. And this chance to write an article is part of what I have tumbling in my mind… yet there is so much more stuck in my head. So, this is a win-win. I get some therapeutical me-time, and I am able to give some self-peace to the rumbling in my mind.

And some of these rumblings are linked (even if by chance) to my environment and what I am observing in life’s history. My primary job in the Navy is Analysis. What I do is read a lot of stuff and figure even more stuff out. And there is a lot of stuff which catches my interest because it falls under my purview in one way or the other. My superpower is that I can make accurate connections to stuff that most people would never realize are indeed relevantly linked. In fact, that is the entire reason why I started Half Life Crisis, so I can speak about all these things that I find relevant, and hopefully be able to shed some light on their vital importance.

And of course, college and a more educated future society is of high interest to me – as a societal variable. I’m in my 40’s so I am not sure if I want to do any more college. But I do love learning something new every day… and I do learn a lot of new stuff every day. It is part of my job. But learning something new intended for public consumption that could benefit others society is not as meaningful if it gets stuck only between my two ears. I am all onboard for people to pursue their higher education if they so desire. But I am unapologetically against for people to be cheated with exorbitant fees when they are trying to make a productive future for themselves.

In many colleges around the world higher education is attainable. In other words, you would not go bankrupted for pursuing a degree, let alone had to pay extremely tuition fees and additional costs for what it's supposed to be your welcoming opportunity to the world.

I know some people have floated around the idea of making college free in USA, much like high school. There is a huge lobby against it, and a lot of acolytes who might or might not really understand the full context behind it. What these dissenters don’t realize is that the proposal is not making EVERY college free, much like not EVERY high school is free.

In fact, even now children’s parents can choose to send their children to a public elementary, middle, and high school in America. Which means no tuition costs for the parents, but a valuable education and an enormous return on investment for the country as a whole. And if the parents want to, they can very well send their kids to a private school of their choice (if they can afford it). And yes, most of those schools are expensive as shit. And yes, in both instances the teachers and staff do get a salary. Although you could argue that public school educators in the US should get a higher salary. But that is a different rant.

The proposal is to do the same with college. Public College for those who desire and all the other universities and colleges that already exists they can choose to keep charging the astronomical fees to those students who choose to attend them – and pay those exorbitant fees. Is that possible? I would say yes, we toss a lot of money in a lot of stupid stuff that are funded by politician’s constituents. Such as political election campaigns that take their elected officials super far away from their actual district or state. So even if somebody is footing the bill, the fact the elected representatives are gone doing something else in the other side of the country, they are by definition not working for ALL their constituents.

Think about this for a second. If a politician, does not matter if right or left of the political spectrum is campaigning for somebody else away from their area… how is this really benefiting ALL their constituents? And I mean all, that means those who voted for and against this incumbent. And taking their entire entourage and flights to all corners of the country… all that shit and more has a much higher price tag than an “expensive” college degree for somebody. Just saying.

My proposal

How about a pilot program on a free college? And see what the return on investment is. Push some people to work on an Associates on a particular skill level and see how this helps the economy (proportionally). Would that work? Spoiler alert, it does. I have friends who have studied abroad with free tuition sponsored by a foreign government. Even on higher level degrees. My friends only had to spend some money for their room and board and learn the language in the country they visited. However, the return of investment was great because it opened commerce-networking between both nations and expanded their culture (for the sponsor country) to the foreign students. And of course, it helped their own country students, because they only had to focus on learning and then applying their skills to the betterment of their county. I won’t say the name of the country today – but it was one of the richest European Countries.

I might talk more about that in a future article or podcast whenever I get a chance to talk to my friends who were afforded these opportunities. The great USA can do as much as that – if desired. With the price of some political contributions this could very well sponsor more than a few people’s entire college degrees. Again, there is a very high return on investment if you make it easier for people to get educated and apply those skills in the economy.

And before you call me any epithet that rhymes with socialist, I am not a socialist, communist, nor a liberal. You know where I am getting this idea from? The mighty United States Navy. I dare anybody in the right-wing side of politics call the U.S. Navy a negative epithet that rhymes with communism. Doctrinally, this is one of the reasons why the U.S. Navy is the world’s mightiest.

I’m actually pretty excited about this idea. Contact me if you want me to discuss the full playbook, because what I will describe is just the apex on the tip of the proverbial iceberg.

The U.S. Navy has countless schools and each school provides lectures. And guess what you get with a lot of these schools? Semester Hour Accredited College credits! Sailors as junior as Second-Class Petty Officers are phenomenal instructors, many Sailors do hold Master Training Specialist qualifications. And their thruput is not only enormous, but it also is immediately relevant to the fleet. In other words, skills learned in these specialized schools serve to maintain fleet readiness.

And guess what? A lot of the curriculum already has their publications, which we don’t make Sailors “buy an expensive text book” – but they do have all the professionally relevant references. And yes, if there is new information it does get added to these books. In other words, no need to spend insane amounts of money on textbooks for pure-profit. And sometimes experts get invited to provide lectures to the class. I have in-fact been invited to facilitate parts of lectures in my area of expertise to some high-level courses. And people have earned college degree credits by stuff I have taught them – if even by proxy, whenever I was invited to support their learning.

In the Navy, just like in the rest of educational institutions – some classes are better than others. Some instructors are better than others. Some school houses are nicer than others. But they all have something in common, their graduates are required to use the knowledge in an applied manner. The ultimate test is not the final exam, but the actual application of these skills in real life.

So, why not give this a try? A free college with accredited college hours, and taught by U.S. Veterans. The text books are printed for the students, there is no tuition fees, all teachers and staff are paid a living wage. And if the students do not pass the class, they have to pay for the cost of the course. Except that is not going to be the prohibiting cost of other colleges and universities. It does not need a gigantic campus, and any donated infrastructure can very well be used as a tax write-off to the donor. Win-win. I’ll give you one better – there is a gargantuan number of unused office spaces and commercial real state all over the county. Use some of those to educate our next generation. Revive all that unused real-state.

Let’s give it a try for a couple of years, see the return on investment based on knowledge and skills pushed back to society. What does that produce? Fully educated, non-indebted citizens who are ready to use their skills in the real world and use their earnings to buy stuff to incentive the economy, rather than having to save every penny to pay high interest loans. Want to learn more, hit me up, we’ll chat.

What I can bet you is that many colleges DO NOT want this to happen. Why? Because then these higher learning institutions would have REAL competition. I say, let’s see who can push better students and have their alumni been better return on investment for the country. Just like we have phenomenal High School students who make our country greater than ever.

We know the return-on-investment works based on how much support a school district gets. Although there are people who want to defund public schools altogether too. But remember what I said. There is a lot of money (for a few greedy people) in keeping people paying exorbitant debt forever.

I don’t know how far my words would travel. But moving the idea from my head into a written form (in this article) is the first step. I will likely write a manuscript about it whenever I finish my current projects. Hopefully with all this context we all can agree that whoever is paying student loans could very well use some respite to start LIVING. There is a much higher return on investment when a person can use their money to buy stuff in the economy, rather than paying high interest fees to some asshole who keeps buying and reselling their debt. These opportunistic entities keep students as slaves of these artificially inflated interest rates. Now you know why this case in the Supreme Court will likely end where it did. HLC