Saving money is wise no matter how rich you are. And if you’re struggling, just imagine for a moment if you had a safety net set aside. Here is a solution!

By the time you reach this article, you might have seen in this site my articles about the 52 weeks and 20 bucks’ savings challenges. Each would guide you to reach a $1,378 and $500 extra in savings respectively – so you can spend it in whatever you want. These two challenges were more about creating a good habit as you pad a bit your savings account. But how about if you can afford to pay yourself a bit more?

How would you spend $2,400.00 USD if you had them in hard cash right now? Some people might not realize that they spend possibly more than that in very frugal parasitical habits. We’ll talk about that later. But even though this might seem like a lot of pocket cash to many, achieving this can help you direct this goal in a way that could benefit you or a loved one.

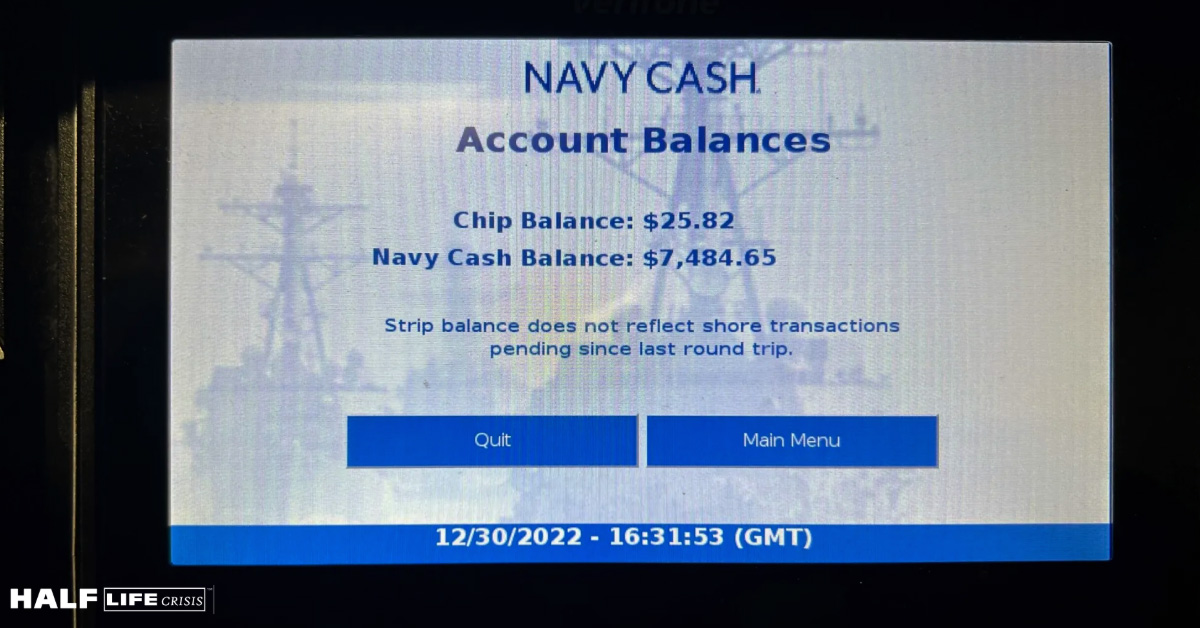

© 2022 Marcelo Baqueroalvarez / HLC | Shot of my Navy Cash Account used for this Money Savings Challenge during deployment.

© 2022 Marcelo Baqueroalvarez / HLC | Shot of my Navy Cash Account used for this Money Savings Challenge during deployment.

The 2,400 Bucks Money Saving Challenge

I designed this challenge when I was helping a very junior Sailors get out of debt. Because he was a junior Sailor, so he was not making tons of money, but he did have a steady paycheck and a roof over his head. But he was spending a bunch his earnings in an unwise manner. With the advice I’m sharing with you, he was not only able to get out of debt, but he actually had a much healthier savings account by the time he transferred. As I mentioned before, it is more about building a good habit. The bonus is that you get some peace of mind and padding to your piggy bank.

How does it work?

Very simple, most people get paid about twice per month. Just put $100.00 aside every time you get paid. If you get paid in a different way, you can always save 100 bucks every two weeks. That’s only $50.00 per week then that adds to $200.00 per month. That’s $2,400.00 in a year. I know that this might seem a bit steep for some, but even if you save a little bit, it will keep adding up.

For example, even if you only save half as much you still get a cool $1,200.00 saved for that year’s challenge. How would you spend an extra $1,200.00 right now? How about twice as much with $2,400.00 bucks? But even if you achieve only one fifth of that, that’s $480.00 put aside. I know that for a lot of people even that would be a beneficial chunk of change.

© 2023 Marcelo Baqueroalvarez / HLC | Shot of US Dollar Coins for New Years savings tradition

© 2023 Marcelo Baqueroalvarez / HLC | Shot of US Dollar Coins for New Years savings tradition

How can this be possible?

Let’s do this quick exercise. Chances are that you’re already spending money in very frivolous things. But since it is a “little amount” each time, it might seem trivial, and you might have not realized how it compounds.

For example, let’s say you work 5-days a week. Every working day you spend about $5.00 between a coffee, and a vending machine stuff, or whatever other little snack. Not something you “need” but just stuff we get because it is there. Let’s say that you do that as part of your routine for the entire year. So, $5.00 x 5 days = $25.00 a week. That’s $50.00 every two weeks, which means $100.00 in a month. Multiply that by 12 months and that’s $1,200.00.

Now, if we are honest with ourselves, you might realize that people tend spend twice as much. Maybe because of smoking or vaping or taking a little extra snack here and there… so let’s average and say that you’re in fact spending about $10.00 per workday. That’s $2,400.00 per year. Hence the $2,400.00 Bucks money saving challenge.

Of course, some people spend a lot more than that a day. Maybe they have lunch or dinner out every day, and their meal is about $20.00 per day adding all the tips and parking and whatever it comes with. That’s $100.00 per week, or $400.00 per month, or $4,800.00 a year. How would you spend $4,800 extra bucks right now? Suddenly that person bringing their lunch and enjoying loving-home-cooked-leftovers does not seem as crazy, huh?

The truth is that we live in a world where small expenses will add up, and they are “cheap enough” to entice us to spend without thinking, while we could be using that money to invest in something more meaningful. I’ve been following my own advice, and normally I’ll use this additional cash for a road trip, invest it somehow, or even just enjoy it with a larger purchase. It is very freeing. I do advise you to put all these savings in an account or place you won’t feel compelled to “harvest” too soon. For example, don’t put that in your wallet or in your checking account. It’s best to put it its own savings or anything that you are not going to feel the temptation of spend unwisely. Again, it is about building a good habit. You’ll be surprised how fast it can start adding up.

Hope this saving tip helps. And yes, you can try this with your own currency and in an amount that makes sense to your economy if your country does not use U.S. Dollars. Please feel free to share it with all your friends and family. Happy Savings! HLC